Reporting is an important aspect of building a successful business and both Xero and Simpro have lots of great reporting options. The key is to understand what reports are available in both systems and how to combine them effectively for both job and business performance outcomes.

Simpro

Simpro reporting should be used for the performance of your actual jobs. More precisely, what it costs to supply materials and labour and what profit you want to make on this.

Profit/Loss Summary Report

This looks at individual transactions on jobs, such as purchase orders, and checks which cost centres the orders were invoiced against when calculating costs. Additionally, the report looks at the date range of individual transactions. If purchase orders were invoiced within the date range, they are included in the report. In some cases this can mean that a job is included in the report because it was invoiced within the date range, but a purchase order raised for that job is excluded, because it was invoiced outside the date range.

Profit/Loss Job Report

This report is used to determine how your business has performed on individual jobs within the specified date range. It is useful to find exceptions on margin levels. It includes invoiced jobs only and focuses on the cost centres on the jobs and when the entire job was invoiced. If the final customer invoice issued for that job is within the date range, the job is included in the report.

Job Productivity

This report breaks down job costs (think labour hours, materials used, etc) per employee to determine how they are performing in your business and if they are meeting any set KPIs. To ensure this report is effective for your business, you will need to make sure your staff are recording accurate and consistent data with each job they complete.

Labour Productivity

This report collects and collates employee and contractor activity in a detailed format which enables you to see how productive those hours have been for various areas in your business.

A lot of businesses lose profitability on staff who spend more time on jobs they are over-qualified for or not charging for regular jobs that may be more time consuming than first quoted and therefor no longer profitable. Overtime is also important as this can throw out the job profitability.

To assist with accurate reporting, make sure your staff have access to tools like the simPRO Mobile app or have a supervisor confirm their timesheets in line with the payroll processing day. This empowers both staff to get paid accurately and supervisors or managers to reach agreed KPI targets.

Job WIP

This snapshot reports displays jobs that were not invoiced in full or archived up to and including the specified date. This is useful for project managers to monitor project jobs with actual costs that have not been invoiced in the time period. It is also an important report in order to utilise figures to journal into Xero ensuring the business has accurate WIP figures towards its assets.

Job Activity

This report displays any activity or transactions made on jobs within the specified date range, and does not normally include committed costs. Job activity or transactions can include:

- receipting purchase orders

- scheduling

- creating invoices, deposits, and progress claims

This is useful for project managers to determine how much to claim on progress claims and ensure cash flow is maintained, as well as to examine which jobs have not been invoiced. You may wish to use this report as a backdated report.

BI Reporting

Most of Simpro’s reporting features are already designed to capture and compare specific sets of data. However, Simpro has a customisable BI Reporting option for those needing more targeted and tailored reporting and enables simPRO users to extract the data that they want from their Simpro build.

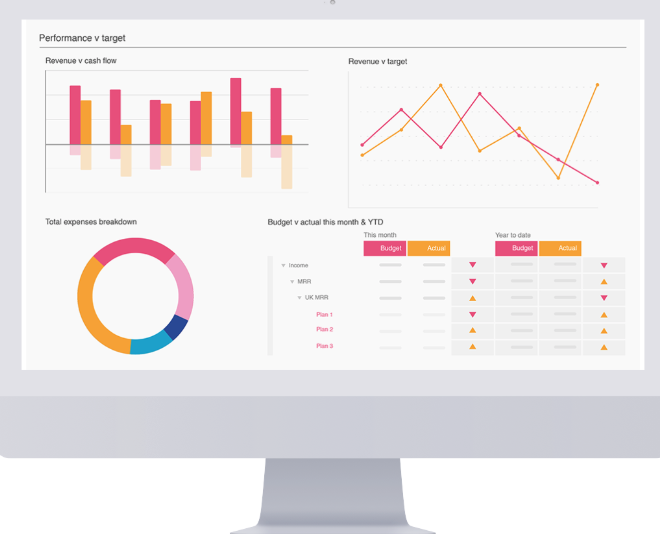

This powerful tool allows you to create your own customised reports, as well as dashboards and data visualisations to assist you in reviewing your team and job performance.

Some examples of the BI Reporting Solvere provides for its clients include:

- Summary of all Technician or Staff Hours broken down into Xero Tracking or Business Groups. This is set on a time variation between Day, Week, Month or Quarter

- Full Labour Reports with detailed technician schedule breakdowns

- Reporting built with full Job and Cost Centre breakdowns

- Custom Grouping of reports

Xero

Xero reporting is the health of your overall business. Most business owners and managers are familiar with a P&L report but you should also consider the following reporting tools in Xero to help guide the success of your business.

Aged Payables & Recievables

The aged receivables can be viewed in both simPRO and Xero if you are syncing the two systems correctly. However, payables will be best managed from Xero. Make sure you have the due dates set correctly if the payables are automated or are entered manually as both options can throw up incorrect due dates.

Profit & Loss

This is very important and if your Xero file is integrating with Simpro there are certain areas you can refine that will provide you with divisional and accurate reporting and automation between the two systems. Tracking a region or department in Xero requires simPRO to be set up to report directly so there is little or no manual manipulation. In Xero this is a link with business groups which need to be set up alongside cost centres. This way the company can report in divisional P&Ls as well as the company as a whole when it integrates across to Xero. It is also important to ensure that everything that is a cost to a job including wages and super for those in the field are reported in direct costs. This will give you a more accurate picture.

Simpro reports to Xero as purchases are receipted. To make sure your margins across the board are accurate a monthly update to your WIP and stock will not only provide your business with accurate asset value when looking at the balance sheet but reduce or increase the monthly purchases. Some purchases will remain in stock so they are not, at that point in time, ‘direct costs’. It is not necessary to turn on Simpro’s inventory tracking but it is important to complete a stock and WIP movement journal at least once a month.

The Profit and Loss will also provide you with the overheads you need to cover which assists with labour and materials pricing. It is recommended these are updated quarterly or when there has been a shift in staffing or material costs.

Balance Sheet

This report will give you the true health of your business and more specifically, what you owe and what is owed to you at a specific point in time. It holds key information on liabilities, or what the business owes, on costs that are not always front of mind like payroll leave accruals, superannuation, GST & PAYG. It also notes any loans or finance the business has in place for things like vehicles, offices or warehouses and other debtors. Some information in the Simpro reports are important to bring across such as movement in stock and movement in WIP.

Cashflow Forecast

With cloud accounting software having real time data, cashflow forecasts can be run on a regular basis and Xero now has a basic cashflow forecast option. If your bank reconciliation is up to date and you have a history of liabilities in your business, you can use this information to build the basics of the forecast. You will however, have to use simPRO reporting to manually add in your expected sales from service job and project reports.

Conclusion

Like most trades businesses, it’s a good idea to focus on what you do well and not spend valuable time on running reports that do not give you the information your business needs or produces misleading information. To be able to use these reports effectively, you also need to make sure you’re capturing the right information to populate them.

If you have any questions on effective reporting or any other job management issues, call us on 1300 446 956 or fill in your details here and we will contact you.