Simpro already has the ability to map Accounting Categories, Business Groups and other data to integrate with Xero and the latest release allows for automated timesheet integration to payroll in Xero. The benefits of this are that Labour reports within Simpro will be more complete, hence better figures on each job and technician productivity. Before you get started, we have put together a few tips on making sure you get the best out of the new feature.

Review Both Systems

First and foremost, it’s a good idea to review a few settings across both systems before you run your first pay run. The new function allows you to map Employees, Scheduled Rates (Normal, 1.5x, 2x etc) and Activities (Leave Types, Travel Time etc). However, like other integration features, you need to ensure the set-up data you have in Simpro matches what you have in Xero for these areas to integrate properly. As part of the review, you should also run a new analysis of each employee’s hourly rate. If you are using the reporting functionality in Simpro it is a good habit to review your employee cost settings every 3 to 6 months.

Connecting Timesheets to Payroll

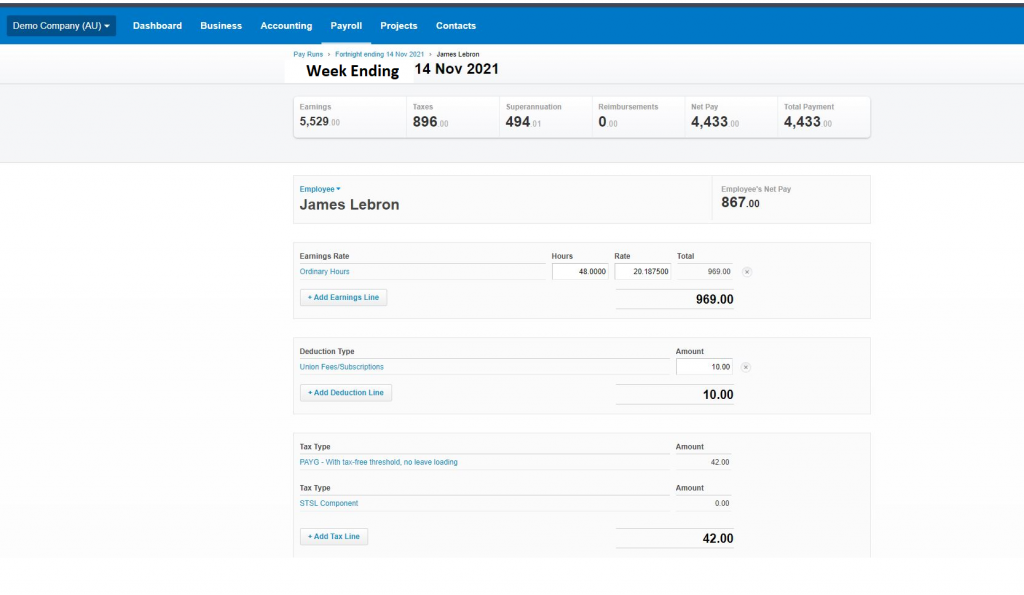

This is done via the Accounting Link set up tab in Simpro. Use the “Map Automatically” feature to automatically map employees, schedule rates and activities (using name, date of birth and email address to find the matching record in Xero). Once you have sent the data, you can view a transaction log that shows whether the transfer was successful and lists any failures and their descriptions.

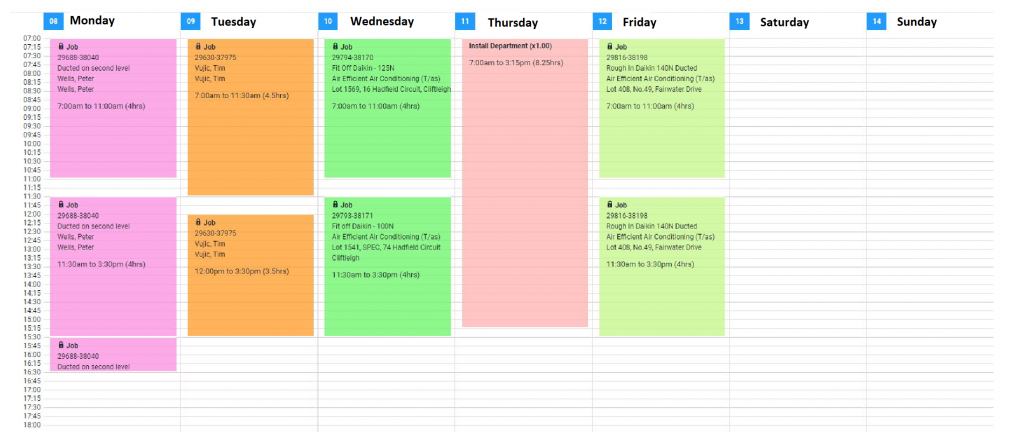

The Process

Once the set-up in both systems is accurate, proper scheduling will need to be completed and the timesheets in Simpro will need to be locked for the desired pay period, including locked jobs and activities. Remember, you can only send the timesheets once to Xero timesheets. If you make any adjustments in Simpro after data has been transferred, it will not be automatically updated in Xero. Leave will also have to be monitored across both as Xero works leave differently to other systems and the leave will need to be logged into Xero before it comes across in the time sheet or the accruals may not work accurately.

Best practice is to open the timesheet directly from the review screen in Simpro to review hours and compare them with the draft pay run in Xero. Once this has been reviewed and is correct, an authorised staff member can post the Xero-based approval.

How Do I Calculate the Hourly Rate?

The Hourly Rate in Simpro is a calculation of the employees hourly pay rate as well as overhead and leave costs. Some companies choose not to include the overhead rate in Simpro as they cater for this element in markups. It is, however, good practice to calculate the mark up cost of each employee in the field to see if the product markups are covering this and ensuring profits are derived from all sales. Make sure these are correct by completing the Overhead Cost Calculator. Remember, the cost of your employee is not just the hourly rate, rather it is the combined cost of overheads such as leave, superannuation and allowances as well as the hourly rate and employee down time.

What About Overtime Triggers?

Every business varies on when overtime will be triggered and also varies according to the individual employee contract. When overtime is in place, there is rarely a formalised agreement stating that 2 hours after Normal Time is paid at one rate, and hours thereafter are paid another etc. Make sure the schedule rate settings in Simpro and Xero match both the company policies and employee agreements.

“We pay more than the Award Rate, so we are covered for Allowances”

This is a common and easy mistake to make. Unless you have an employment agreement in place that specifically states the pay rate for an employee is inclusive of allowances, and it names every allowance applicable, there’s a possibility your employee can claim that these were not paid at a later date and claim a back-payment. Make sure you have an employment agreement in place with your staff that clearly defines what hours your employee is engaged for, and what the salary or hourly rate covers.

Tracking Codes in Xero & Business Groups in Simpro

One of the biggest requirements for many trades using Simpro is to track expenses and income in the Xero P&L. This is very important for companies who also have overheads related to the tracking code. For instance, departmental tracking or regional tracking. With this in mind you may consider a BI built to track the business groups against the cost centres in the Simpro schedule/time sheet. This can be built to track the percentage of each individual against each department, region or tracking code. A journal can be set up in Xero to recur so the bookkeeper/accountant will only have to complete this monthly with the percentages. This will then track the wages into the Xero tracking codes.

Automation is great when you get it right and the combination of Simpro and Xero is highly effective. Solvere specialises in the holistic approach across all business systems with an accounting edge and we know that our clients did not go into business to specialise in payroll and accounting integrations. If you are unsure on the set-up of either Simpro or Xero, or any reporting emanating from your two systems then make sure you use a specialist to help you set up your systems effectively to get the best out of your job management and cloud accounting.